Exhibit 99.1

| PRESS RELEASE | NASDAQ: IPX | ASX: IPX January 28, 2025 |

IperionX Limited (Nasdaq | ASX: IPX) is pleased to present its quarterly report for the period ending December 31, 2024. Key highlights during and subsequent to the end of the quarter include:

First “End to End” Titanium Powder Production in Virginia

| • | Following successful commissioning of the HAMR™ (Hydrogen Assisted Metallothermic Reduction) furnace last quarter, IperionX completed the inaugural “end-to-end” commercial HAMR production cycle, efficiently deoxygenating high-oxygen titanium scrap and producing high-quality, low-oxygen titanium metal powder. |

| • | Progressive commissioning of the Titanium Manufacturing Campus in Virginia continued on pace, with multiple process improvements identified that are expected to increase production capacity beyond nameplate levels by late 2025. |

Advanced Titanium Product Manufacturing

| • | IperionX capitalized on its increased titanium powder production to prioritize product development and customer demand for high-value, near-net-shape titanium metal products manufactured via powder metallurgy and HSPT™ (Hydrogen Sintering and Phase Transformation). |

| • | HSPT is a patented and ground-breaking sintering technology that allows IperionX to make near-net titanium shapes or mill products with “forged” quality directly from titanium powder, resulting in a simpler, faster and lower cost manufacturing process. |

| • | To meet the growing demand for these parts, IperionX commissioned a new 100-ton uniaxial hydraulic powder metallurgy press and ordered additional critical equipment to increase capacity for pressing and HSPT in 2025. |

Research & Development

| • | IperionX made significant advancements across its proprietary titanium technologies and processes, addressing increased efficiency, lower capital intensity, and eliminating processing steps. |

| • | IperionX reconfigured the Salt Lake City Industrial Pilot Facility to focus on producing and recycling new alloys using HAMR and HSPT, including zirconium and refractory metals such as niobium and tantalum. |

| • | IperionX continued to advance its ARH™ (Alkaline Roasting Hydrolysis) and Green Rutile™ technologies to develop low-cost, US-sourced titanium feedstocks with minerals from IperionX’s Titan Critical Minerals Project. |

Acquisition of Titanium Technologies

| • | IperionX completed the acquisition of the intellectual property that comprises the Company’s titanium technology portfolio for a final payment of US$6 million, consolidating its exclusive commercial rights to these breakthrough processes. |

| • | These proprietary titanium technologies offer major advantages over the traditional Kroll process, including lower energy consumption, lower capital intensity, faster production cycles, higher production yields and lower costs. |

U.S. Government Activities

| • | Lieutenant General Ross Coffman (ret) joined as IperionX Defense Advisor, providing strategic direction on titanium product development for the U.S. Army and other defense agencies. |

| • | IperionX continued to advance applications for U.S. government funding, with potential for accelerated review under the new Administration. |

| North Carolina | Tennessee | Virginia | Utah |

| 129 W Trade Street, Suite 1405 Charlotte, NC 28202 | 279 West Main Street Camden, TN 38320 | 1092 Confroy Drive South Boston, VA 24592 | 1782 W 2300 S West Valley City, UT 84119 |

Strong Financial Position

| • | At December 31, 2024, IperionX held US$77.1 million in cash, with an additional US$4.1 million available under the DPA Title III funding program – ensuring strong liquidity to scale operations at the Titanium Manufacturing Campus. |

| • | IperionX raised approximately US$66 million (~A$100 million) through the issuance of 31.25 million new fully paid ordinary shares. |

For further information and enquiries please contact:

investorrelations@iperionx.com

+1-980-237-8900

2

TITANIUM METAL OPERATIONS UPDATE

First “End to End” Titanium Powder Production in Virginia

After successfully commissioning the HAMR furnace last quarter, IperionX achieved its first “end to end” production run of titanium metal powder at its Titanium Production Facility in Halifax County, Virginia. This production run applied IperionX’s HAMR process to high-oxygen titanium scrap feedstock, and successfully deoxygenated and processed the scrap into low-oxygen, high-quality titanium metal powder.

Progressive commissioning of the Virginia facility continued apace in preparation for routine titanium production cycles. Multiple process improvements were identified that are expected to increase titanium production capacity beyond nameplate levels by late 2025.

Figure 1 (clockwise from top left): Titanium scrap; Finished titanium metal powder; IperionX metal production team with a

drum of finished titanium metal powder in front of the HAMR furnace at the Titanium Production Facility.

3

Figure 2: Development activity in July 2024 (LHS) compared to January 2025 (RHS), with external infrastructure installed,

including argon storage tank & vaporizers, jet mill bag house and cooling water towers.

High-Value Titanium Product Development and Manufacturing

IperionX continued to add and commission critical equipment at its Advanced Manufacturing Center in Virginia where it uses the high-quality titanium powders produced at the Titanium Production Facility to manufacture a range of titanium products including semi-finished traditional mill products, near-net-shape forged titanium components, and titanium products using the ground-breaking, patented HSPT process.

Figure 3 (clockwise from left): 100 ton uniaxial hydraulic press operations; Pre-HSPT fastener (LHS) and post- HSPT and

threaded fastener (RHS); Pre-HSPT bars / pucks.

The HSPT technology allows IperionX to make high-quality titanium metal products directly from powder, without the need for high-energy and high-cost vacuum melting used in typical manufacturing processes. IperionX uses traditional powder metallurgy pressing equipment, including uniaxial pressing or cold isostatic pressing, to press metal powder into near net shapes, then directly sinters those shapes into titanium metal products with forged-like quality without the extreme waste and costs of the traditional ingot to final product manufacturing process (which in many cases exceeds 10 tons of product for 1 ton of final machined component).

4

During the quarter, IperionX took advantage of its increased powder production to address product development and customer orders for high-value, near-net-shape titanium metal products manufactured using powder metallurgy and HSPT. To meet the growing customer demand for these parts, IperionX commissioned a new 100-ton uniaxial hydraulic powder metallurgy press and placed orders for additional critical equipment that will further increase capacity for pressing and HSPT in 2025.

Research & Development Activities

IperionX made significant progress towards optimizing and developing the HAMR process, identifying improvements that increase efficiency, eliminate process steps and reduce capital intensity.

IperionX reconfigured the Salt Lake City Industrial Pilot Facility to focus on producing and recycling new alloys using HAMR and HSPT, including alloys containing zirconium and refractory metals such as niobium and tantalum.

IperionX continued to advance its ARH and Green Rutile technologies, with the aim to produce low-cost, US- sourced titanium feedstocks with minerals from IperionX’s Titan Critical Minerals Project.

Acquisition of Breakthrough Titanium Technologies

IperionX successfully completed the acquisition of the intellectual property comprising the titanium technology portfolio for a final payment of US$6 million, securing its exclusive commercial rights to the breakthrough technologies. Combined, these complementary technologies offer transformative advantages over the traditional Kroll process, including lower energy consumption, lower capital intensity, faster production cycles, higher yields and the ability to use either 100% recycled titanium scrap or titanium minerals as feedstock.

Together, these technologies, when combined with IperionX’s 100% owned and permitted Titan Mineral Project in Tennessee, make IperionX the only company in the U.S. that can offer a secure and uninterruptible mineral to metal titanium supply chain for national security and industry.

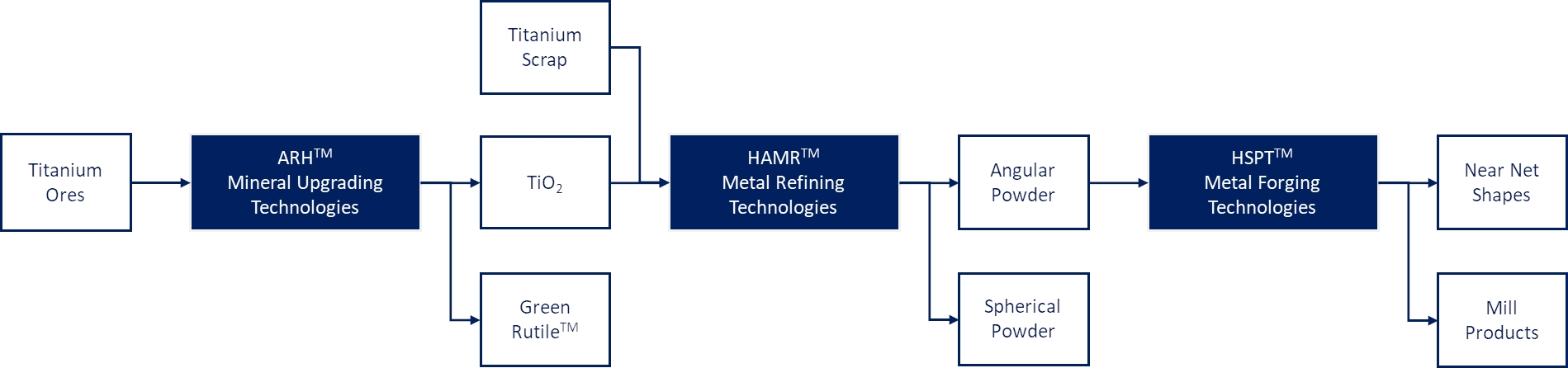

Figure 4: IperionX titanium (& other reactive metal) technologies map.

The core technologies that enable an end-to-end titanium metal solution can be broadly categorized as:

| • | Mineral Upgrading Technologies (ARH & Green Rutile): Alkaline Roast & Hydrolysis (ARH) involves a series of industrial process steps to produce high-purity TiO2 and a by-product of high-purity Fe2O3 with a high degree of particle size and final chemical composition. The initial steps of ARH can also produce Green Rutile, a zero-carbon replacement for synthetic rutile, together with a high purity Fe2O3. The ARH and Green Rutile processes can be applied to almost any titanium mineral ores sourced globally, in addition to producing high purity TiO2 and synthetic rutile. |

| • | Metal Refining Technologies (HAMR & GSD): Hydrogen Assisted Metallothermic Reduction (HAMR) is a breakthrough titanium metal reduction process that deoxygenates either titanium mineral or titanium scrap to make low-oxygen, high-purity titanium metal. HAMR simplifies and eliminates the energy and carbon intensive and high-cost steps of the Kroll/Ingot supply chain. HAMR produces high-quality titanium metal powder in an angular/irregular form with a high degree of control on particle size: a product that has been almost impossible to achieve in the industry today. Thermomechanical pre-processing steps can be applied prior to the HAMR process to form spherical powders with a high degree of control on particle size. This process is known as Granulation Sintering and Deoxygenation (GSDTM), with these powders having shown equivalent properties to traditional gas or plasma atomized powders in the market today. Additionally, direct HAMR angular powder can also be used as a feedstock into plasma spheroidization to produce atomized powder with a high degree of control on particle size and resultant yield. HAMR has also shown great potential in the deoxygenation of other reactive metals like zirconium, hafnium, niobium and tantalum. |

5

| • | Metal Forging Technologies (HSPT): HSPT is a ground-breaking sintering process that allows for the manufacturing of high-quality titanium metal products with fine and ultra fine microstructures that are equivalent or better than traditional mill products: a feature that has previously been impossible with the sintering of titanium metal powders. A derivative technology of HSPT, the THRM™ process, can be applied to third-party manufactured titanium products to impart better properties. The combination of high-quality and low-cost HAMR angular powders together with HSPT sintering of these powders unlocks potential for high-quality titanium products via simple, high-volume and low-cost powder metallurgy pressing processes that can manufacture near-net-shapes and traditional mill products with an order of magnitude improvement on yields over the traditional Kroll/Ingot supply chain. |

CUSTOMER AND PRODUCT DEVELOPMENT

IperionX has built a large pipeline of potential customers with whom the Company is actively undertaking assessments, prototyping and testing of titanium metal products across a range of sectors including consumer electronics, automotive, green hydrogen, luxury goods, aerospace and defense. Progress achieved during the quarter at the Titanium Manufacturing Campus in Virginia led to a significant increase in prototyping and product validation work, with strong potential to convert prototyping work to sales contracts in the coming months.

In addition to new and existing customer focus, IperionX is exploring growing demand from industries that require precision-machined components. These industries include luxury goods and fasteners, which supply both the industrial and military sectors. IperionX is assessing additional strategies for developing in-house capability to meet these needs.

U.S. GOVERNMENT ACTIVITIES

The U.S. government requested information and proposals for providing additional government funding to re-shore a secure, low-cost and sustainable domestic titanium supply chain. These opportunities are focused on titanium supply chains that utilize both scrap titanium and U.S. titanium minerals as feedstocks. IperionX believes it is well-positioned to qualify for these additional U.S. government funding opportunities to scale domestic titanium production and manufacturing capacity.

IperionX continues to track previously submitted applications for U.S. government funding, with the potential for accelerated outcomes under the new administration. Further, IperionX continues to progress its equipment finance application with EXIM Bank, advancing further through major EXIM milestones.

A select list of U.S. government funding opportunities is shown below:

| Agency | Program | Total program funding available (2024-2025)1 | |||

| U.S. Department of Defense | IBAS – Casting & Forgings Infrastructure Investments | ~US$80m | |||

| U.S. Department of Defense | DPA – Ukraine Supplemental Bill Funding for Strategic and Critical Materials | US$140m remains, as of March 2024 | |||

| U.S. Department of Defense | DPA Title III – Casting & Forgings Initiative | ~US$80m | |||

| U.S. Department of Defense | SBIR Phase III | Up to US$50-100M in funding |

Table 1: U.S. government funding opportunities.

During the quarter, Lieutenant General Ross Coffman (ret) joined as IperionX Defense Advisor, providing strategic direction on titanium product development for the U.S. Army and other defense agencies.

1 Estimates of total funds available under each program based upon Department of Defense FY25 budget request materials released in March 2024, and other U.S. government guidance. IperionX’s potential access to these funding programs is subject to successful application, award and contract under each program.

6

TITAN CRITICAL MINERALS PROJECT

Strategic & offtake partners - multiple companies in advanced due diligence

IperionX continues to receive strong commercial interest in the Titan Project’s critical minerals, including titanium, rare earths and zircon. A major Japanese conglomerate completed metallurgical test work to advance potential sales offtake and development financing. A range of other commercial opportunities for potential offtake/investment at the Titan Project have also arisen, paving the way for potential offtake agreements and development financing.

A number of other partnering options, including the U.S. government, remain as potential sources of development finance for the Titan Project, including funding under a proposal submitted to co-fund the Titan Project Pre-Feasibility and/or Feasibility Study, and to co-fund the scale-up of IperionX’s mineral enrichment technologies and the Virginia Titanium Manufacturing Campus.

BALANCE SHEET AND CORPORATE

Completion of $66 million placement

IperionX completed a placement of 31.25 million new fully paid ordinary shares at an issue price of A$3.20 per share to raise gross proceeds of approximately $66 million (A$100 million). Proceeds from the placement will be applied to Virginia titanium production campus expansions (including studies, equipment and working capital), ongoing Virginia development and operations, acquisition of intellectual property, and for general working capital and corporate purposes.

Strong Financial Position

As of December 31, 2024, IperionX held US$77.1 million in cash with an additional US$4.1 million available under the DPA Title III program, which places the Company in a strong financial position to ramp-up and optimize the initial production line and further scale production at the Titanium Manufacturing Campus.

IperionX is in a strong financial position as it rapidly ramps up operations in Virginia ahead of its first major customer production requirements being met by mid-2025, and will take a prudent approach to future expansion activities, informed by data and optimization test work occurring over the coming months.

ASX - ADDITIONAL INFORMATION

The Titan Project is prospective for critical mineral sands including titanium minerals, rare earth minerals, high grade silica sand and zircon minerals. As of December 31, 2024, the Titan Project comprised approximately 10,702 acres of surface and associated mineral rights in Tennessee, of which approximately 1,486 acres are owned by IperionX, approximately 338 acres are subject to long-term lease by IperionX, and approximately 8,878 acres are subject to exclusive option agreements with IperionX. These exclusive option agreements, upon exercise, allow IperionX to lease or, in some cases, purchase the surface property and associated mineral rights.

During the quarter approximately 96 acres of optioned properties were exercised and converted into long term leases, and approximately 352 acres of optioned properties were relinquished due to low prospectivity.

Mining exploration expenditures

During the quarter, the following payments were made for mining exploration activities:

| US$000 | ||

| Land consultants | 20 | |

| Sustainability | 20 | |

| Community relations | 2 | |

| Field supplies, equipment rental, vehicles, travel and other | 19 | |

| Total as reported in Appendix 5B | 61 |

Table 3: Mining exploration expenditures

7

During the quarter, IperionX made no payments in relation to mining development or production activities.

Related party payments

During the quarter, IperionX made payments of US$297,000 to related parties and their associates. These payments relate to executive directors’ remuneration, non-executive directors’ fees, employer 401(k) contributions, and superannuation contributions.

ABOUT IPERIONX

IperionX aims to be the leading American titanium metal and critical materials company – using patented and proprietary metal technologies to produce high performance titanium alloys, from titanium minerals or scrap titanium, at lower energy, cost and carbon emissions.

Our Titan critical minerals project is the largest JORC-compliant mineral resource of titanium, rare earth and zircon minerals sands in the U.S.

IperionX’s titanium metal and critical minerals are essential for advanced U.S. industries including aerospace, defense, consumer electronics, hydrogen, electric vehicles and additive manufacturing.

This announcement has been authorized for release by the CEO & Managing Director.

| Forward Looking Statements Information included in this release constitutes forward-looking statements. Often, but not always, forward looking statements can generally be identified by the use of forward-looking words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “continue”, and “guidance”, or other similar words and may include, without limitation, statements regarding the timing of any Nasdaq listing, plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production outputs. Forward looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance, and achievements to differ materially from any future results, performance, or achievements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licenses and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which the Company operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation, as well as other uncertainties and risks summarized in filings made by the Company from time to time with the Australian Securities Exchange and in the Form 20-F filed with the U.S. Securities and Exchange Commission. Forward looking statements are based on the Company and its management’s assumptions relating to the financial, market, regulatory and other relevant environments that will exist and affect the Company’s business and operations in the future. The Company does not give any assurance that the assumptions on which forward looking statements are based will prove to be correct, or that the Company’s business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by the Company or management or beyond the Company’s control. There may be other factors that could cause actual results, performance, achievements, or events not to be as anticipated, estimated or intended, and many events are beyond the reasonable control of the Company. Accordingly, readers are cautioned not to place undue reliance on forward looking statements. Forward looking statements in these materials speak only at the date of issue. Except as required by applicable law or stock exchange listing rules, the Company does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in events, conditions or circumstances on which any such statement is based. Competent Persons Statement The information in this announcement that relates to Exploration Results is based on information compiled and/or reviewed by Mr. Adam Karst, P.G. Mr. Karst is a consultant to IperionX. Mr. Karst is a Registered Member of the Society of Mining, Metallurgy and Exploration (SME) which is a Recognized Overseas Professional Organization (ROPO) as well as a Professional Geologist in the state of Tennessee. Mr. Karst has sufficient experience which is relevant to the style and type of mineralization present at the Titan Project area and to the activity that he is undertaking to qualify as a Competent Person as defined in the 2012 edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” (the 2012 JORC Code). Mr. Karst consents to the inclusion in this report of the matters based on this information in the form and context in which it appears. The information in this announcement that relates to Mineral Resources is extracted from IperionX’s ASX Announcement dated October 6, 2021 (“Original ASX Announcement”) which is available to view at IperionX’s website at www.iperionx.com. IperionX confirms that a) it is not aware of any new information or data that materially affects the information included in the Original ASX Announcement; b) all material assumptions and technical parameters underpinning the Mineral Resource Estimate included in the Original ASX Announcement continue to apply and have not materially changed; and c) the form and context in which the relevant Competent Persons’ findings are presented in this report have not been materially changed from the Original ASX Announcement. |

8

Rule 5.5

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

| Name of entity | ||

| IperionX Limited | ||

| ABN | Quarter ended (“current quarter”) | |

| 84 618 935 372 | December 31, 2024 | |

| Consolidated statement of cash flows | Current quarter USD$’000 | Year to date (6 months) USD$’000 | |

| 1. | Cash flows from operating activities | | |

| 1.1 | Receipts from customers | - | 500 |

| 1.2 | Payments for | | |

| (a) exploration & evaluation | (61) | (87) | |

| (b) development | - | - | |

| (c) production | - | - | |

| (d) staff costs | (4,913) | (7,219) | |

| (e) administration and corporate costs | (1,642) | (2,232) | |

| 1.3 | Dividends received (see note 3) | - | - |

| 1.4 | Interest received | 648 | 1,012 |

| 1.5 | Interest and other costs of finance paid | (91) | (120) |

| 1.6 | Income taxes paid | - | - |

| 1.7 | Government grants and tax incentives | - | - |

| 1.8 | Other (provide details if material): | ||

| (a) research & development | (999) | (2,341) | |

| (b) business development | (109) | (192) | |

| 1.9 | Net cash from / (used in) operating activities | (7,167) | (10,679) |

| 2. | Cash flows from investing activities | ||

| 2.1 | Payments to acquire: | ||

| (a) entities | - | - | |

| (b) tenements | (292) | (420) | |

| (c) property, plant and equipment | (2,180) | (5,010) | |

| (d) exploration & evaluation | - | - | |

| (e) investments | - | - | |

| (f) other non-current assets | - | - |

| Appendix 5B |

| Mining exploration entity and oil and gas exploration entity quarterly report |

| Consolidated statement of cash flows | Current quarter USD$’000 | Year to date (6 months) USD$’000 | |

| 2.2 | Proceeds from the disposal of: | ||

| (a) entities | - | - | |

| (b) tenements | - | - | |

| (c) property, plant and equipment | - | - | |

| (d) investments | - | - | |

| (e) other non-current assets | (6,000) | (6,000) | |

| 2.3 | Cash flows from loans to other entities | - | - |

| 2.4 | Dividends received (see note 3) | - | - |

| 2.5 | Other (provide details if material) | - | - |

| 2.6 | Net cash from / (used in) investing activities | (8,472) | (11,430) |

| 3. | Cash flows from financing activities | | |

| 3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) | 66,151 | 70,245 |

| 3.2 | Proceeds from issue of convertible debt securities | - | - |

| 3.3 | Proceeds from exercise of options | - | 120 |

| 3.4 | Transaction costs related to issues of equity securities or convertible debt securities | (2,490) | (2,578) |

| 3.5 | Proceeds from borrowings | - | - |

| 3.6 | Repayment of borrowings | - | - |

| 3.7 | Transaction costs related to loans and borrowings | - | - |

| 3.8 | Dividends paid | - | - |

| 3.9 | Other (provide details if material) (a) principal portion of lease liabilities | (152) | (241) |

| 3.10 | Net cash from / (used in) financing activities | 63,509 | 67,546 |

| 4. | Net increase / (decrease) in cash and cash equivalents for the period | ||

| 4.1 | Cash and cash equivalents at beginning of period | 30,400 | 33,157 |

| 4.2 | Net cash from / (used in) operating activities (item 1.9 above) | (7,167) | (10,679) |

| 4.3 | Net cash from / (used in) investing activities (item 2.6 above) | (8,472) | (11,430) |

| Appendix 5B |

| Mining exploration entity and oil and gas exploration entity quarterly report |

| Consolidated statement of cash flows | Current quarter USD$’000 | Year to date (6 months) USD$’000 | |

| 4.4 | Net cash from / (used in) financing activities (item 3.10 above) | 63,509 | 67,546 |

| 4.5 | Effect of movement in exchange rates on cash held | (1,147) | (1,471) |

| 4.6 | Cash and cash equivalents at end of period | 77,123 | 77,123 |

| 5. | Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts | Current quarter USD$’000 | Previous quarter USD$’000 |

| 5.1 | Bank balances | 52,463 | 21,068 |

| 5.2 | Call deposits | 24,660 | 9,332 |

| 5.3 | Bank overdrafts | - | - |

| 5.4 | Other (provide details) | - | - |

| 5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 77,123 | 30,400 |

| 6. | Payments to related parties of the entity and their associates | Current quarter USD$’000 |

| 6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | 297 |

| 6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | - |

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments

| Appendix 5B |

| Mining exploration entity and oil and gas exploration entity quarterly report |

| 7. | Financing facilities Note: the term “facility’ includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. | Total facility amount at quarter end USD$’000 | Amount drawn at quarter end USD$’000 |

| 7.1 | Loan facilities | - | - |

| 7.2 | Credit standby arrangements | - | - |

| 7.3 | Other (please specify) | - | - |

| 7.4 | Total financing facilities | - | - |

| 7.5 | Unused financing facilities available at quarter end | - | |

| 7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. | ||

| Not applicable | |||

| 8. | Estimated cash available for future operating activities | USD$’000 |

| 8.1 | Net cash from / (used in) operating activities (item 1.9) | (7,167) |

| 8.2 | (Payments for exploration & evaluation classified as investment activities) (item 2.1(d)) | - |

| 8.3 | Total relevant outgoings (item 8.1 + item 8.2) | (7,167) |

| 8.4 | Cash and cash equivalents at quarter end (item 4.6) | 77,123 |

| 8.5 | Unused finance facilities available at quarter end (item 7.5) | - |

| 8.6 | Total available funding (item 8.4 + item 8.5) | 77,123 |

| 8.7 | Estimated quarters of funding available (item 8.6 divided by item 8.3) | 10.8 |

| Note: if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. | ||

| 8.8 | 8.8.1. Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | |

| Not applicable. | ||

| 8.8.2. Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | ||

| Not applicable. | ||

| 8.8.3. Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | |

| Not applicable. | |

| Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. |

| Appendix 5B |

| Mining exploration entity and oil and gas exploration entity quarterly report |

Compliance statement

| 1 | This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A. |

| 2 | This statement gives a true and fair view of the matters disclosed. |

| Date: | January 28, 2025 | |

| Authorized by: | Chief Financial Officer | |

| (Name of body or officer authorizing release – see note 4) |

Notes

| 1. | This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so. |

| 2. | If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report. |

| 3. | Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity. |

| 4. | If this report has been authorized for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorized for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorized for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”. |

| 5. | If this report has been authorized for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively. |

| ASX Listing Rules Appendix 5B (17/07/20) | Page 5 |

| + See chapter 19 of the ASX Listing Rules for defined terms. |